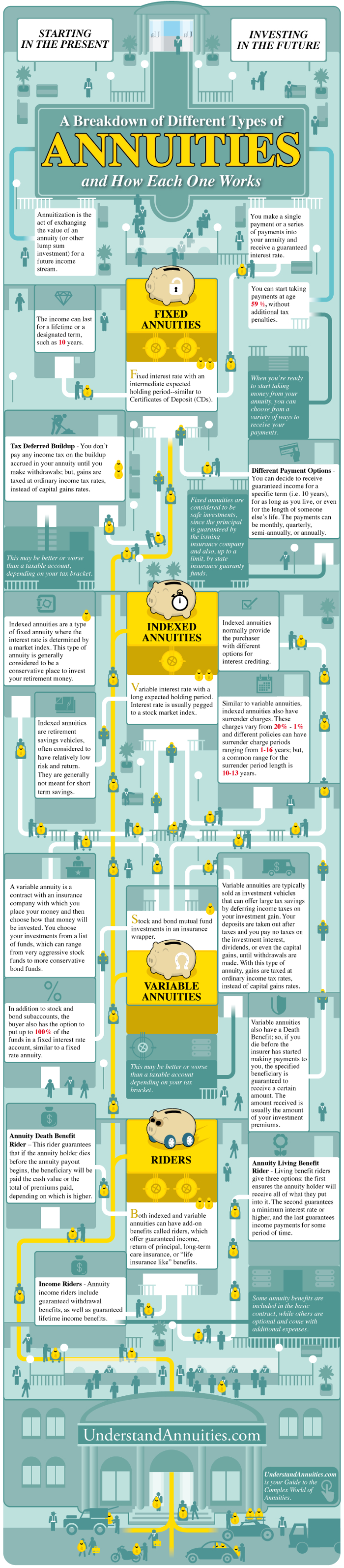

Annuities likely to be complicated and lots of investors might buy single based on a tempting sales pitch without completely understanding the whole negatives and positives related with the annuity agreement. It is encouraged to read the whole agreement, and pay attention to the fine print to know all the advantages and disadvantages prior to choosing when the annuity is the most option to meet the objectives.

4 Fixed Index Annuity Pros

1. Low Participation Rate

The contribution rate is well thought out the solitary most significant aspect for this agreement. This is a raw index development part which is attributed to the pension account. The efficient yield rate is advanced together with an advanced participation rate. The rates might sort between fifty and ninety percent, and will differ amongst agreements.

2. Assured Amount for Annuity Having an assured least amount return for the annuity is perhaps the largest and essential benefits. Some might have a 3% yearly interest rate with the 90% paid premium.

3. Utilize Indexed Annuity for Retirement Tool

An extra perk for utilizing indexed annuity as your retirement tool is the tax deferred development as well as interest credits obtain on the yearly date.

4. Gained Interest

Future reduces will not have an impact to the interest which a contract owners gains. Normally, gained interest is enclosed in on a yearly basis. The value resets yearly. So, the annuity could credit further interest than annuities which utilize other ways if index fluctuations happen.

Fixed Index Annuity Cons

While the benefits can present many investing possibilities, there are also drawbacks to index annuities for many traders and investors. As the index annuities differ based on agreement terms, not every trader might face several advantages.

1. Investments

Normally, traders will encounter a ten percent internal revenue service tax charge once the investments is give up too early. Surrender fees can decrease to 0 in fifteen years except if the traders requires access the cash sooner. They can face a fifteen to twenty percent charge of the asset amount for untimely withdrawals, additional to the internal revenue service penalty.

2. Abusice Sales Strategies

Another drawback is the foul or rude abusive sales strategies which threaten reliable and steady product legality. Some commission charges were thirteen percent in this case.

3. Rate of Participation

The rate of participation for the annuities might change annually and lead to lower rate compared to other ways utilized for indexing. A rearrange design on a yearly basis can utilize an averaging edge or cap which bounds the whole amount traders can gain every year.

4. Last Term Interest

Another disadvantage is the reason that the interest isn’t attributed until last term. With most annuities, giving up the annuity prior the term lasts gets rid of the application of index linked interest.

There are no ideal retirement techniques or investments which solve each contingency. It is further possible that a blend of investment techniques as well as financial tools will eventually provide you the expanded retirement plan which you are searching for. Fixed index annuities provides benefits which may suggest a introductory position in the retirement planning, but they are not without the drawbacks.