A FHA mortgage can be an ideal way for many households and individuals to eligible for a home loan. On the other hand, any loan must not be entered into without thinking about the advantages and disadvantages. Understanding the pros and cons will assist you visualize what this kind of mortgage entails.

FHA Loan Pros

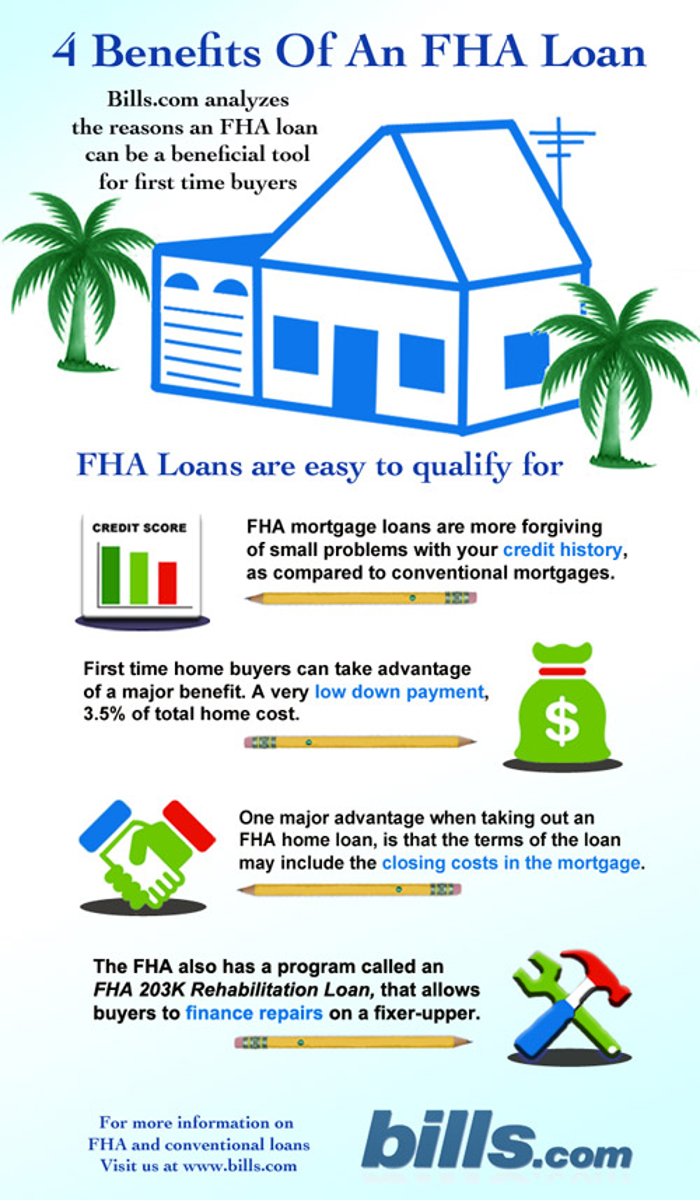

1. Lots of Cost Saving Areas

Customer is permitted to lend with as low as 3 percent interest for the initial payment. This is a huge benefit as opposed to typical loans wherein you are needed to pay a higher deposit of 20 up to 25 percent. Moreover, families can assist git, cosign and pay costs. The seller can disburse closing expenses and to six percent on the procurement cost in closing price and deal points and some usual typical loan fees are not permitted.

2. Simpler to Qualify Compared to Typical Loan

FHA mortgages have simpler approval as of higher qualifying rates of 29 percent for housing for present construction and 43 percent for new development. Moreover, the guarantees standards are flexible. Meaning, still you can qualify even if you have bad credit record or even a record of bankruptcy or foreclosure.

3. No Penalty

Meaning, you are free from charged because of paying late. This is a good addition because a lot of people gain more taking as they get older and afford to disburse these mortgages early. Lacked of penalty means you can save a significant amount which you can utilize for other important matters.

4. FHA loan is assumable with qualifications

New home buyers can take over the present loan terms without triggering due on sale clauses which are more popular with other typical home loans.

FHA Loan Cons

1. Low Amount for loan Limits

Potential home buyer might not be capable to qualify for the total amount of financing they want to get the kind of home they are searching for. This might lead in the individual and family settling for a lesser house.

2. Private Loan Insurance is Needed in spite of the sum of the initial payment

You cannot really prevent needing to pay this addition to your monthly loan payment. But, you can recompense the loan early.

3. FHA Loans tend to have many requirements compared to other type of loans

Because you are necessarily covered by the federal government for the loans and are not giving out more amounts of money as typical home mortgages, you will need to fill out documents than a typical mortgage will need.

There are many pros and cons of FHA loans. Always keep in mind that FHA mortgages will refinance to a typical loan if they make enough fairness to drop off the loan insurance. This is a good indication of the choice for typical mortgages over these kinds of loans. On the other hand, it’s no secret that these kinds of loans have assisted a lot of people get the home they want and allow them to move on to a better and bigger houses as well as financing.