HSA stands for Health Savings Account which started to exist in 2003 particularly at the time when the Congress accepted it as a part of the wider Medicare reform. HSA allows the qualified American citizens to save money from their present and future medical expenses. This benefit can be obtained by dropping tax-deductible contributions in an account that is administered by the trustee.

A health savings account can provide you with better control over your health care savings. Hence, you could pay for out-of-the-pocket health care expenses by using your account. Once you go beyond the deductible cost, you can pay the fees by using your HDHP or Highly Deductible Health Plan.

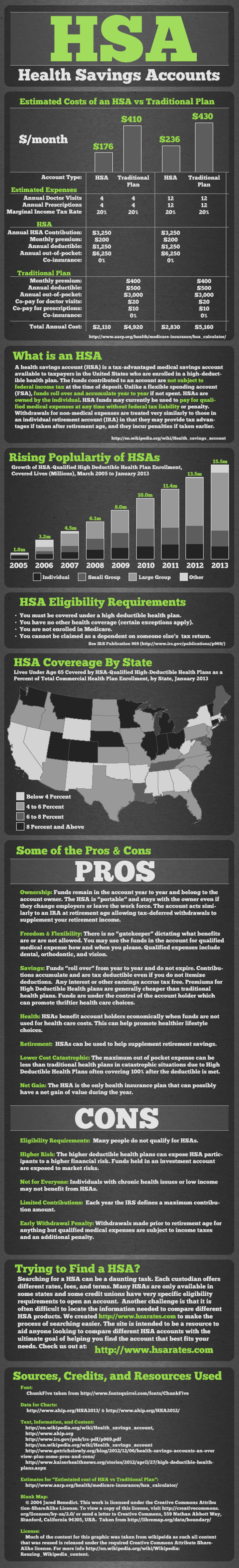

Whilst the account offers savings and tax benefits, HSA also comes with certain drawbacks as well as limitations that may depend on your healthcare requisites. The following are the positive and negative ideas about HSA.

The Pros of HSA

HSA will bring great things in your life like:

1. The biggest advantage of a health savings account is the contribution that has been made with it will be completely tax-deductible and it will keep on growing every year.

2. When you reach the age of 55, you will be given the chance to gain extra contributions to your account.

3. Another positive thing to know about a health savings account is the overall control that is given to you which is about the process of how your medical expenditures are spent and where the money goes. For a person who cannot manage to pay for high cost health insurance plans, having a health savings account will be the best alternative.

4. Your employer can also prefer to contribute to your own health savings account. There’s no restriction or any rule to be followed about the person who can deposit cash in your own account provided that it is within the limit. This scenario makes HSA as the ideal option for employers as well.

The Cons of HSA

On the other hand, HAS can also cause some problems that you have to learn and understand. The following are the disadvantages of having a health savings account:

1. The penalty to be imposed is one of the major disadvantages that accompany HSA. This will be possible once the money in your account is withdrawn and used for any non-medical purposes.

2. Choosing to have a health savings account is not a smart choice for all. If you are highly susceptible to some medical medications that may develop as time goes by or if you have dependents and they are at a high risk then you should not consider HSA. For these cases, choosing to have a health insurance plan that offers greater coverage will be the right choice.

How Do You Feel about HSA?

Before you decide to open an account, you must calculate first all your medical fees for the coming days and determine whether an HDHP with HSA can cover all of these financial obligations effectively. If you think that it’s the solution that can provide you with ample coverage then go for it. After all, everything will depend on you so just be wise when making decisions.